According to the report published by Allied Market Research, the global micropump market generated $1.65 billion in 2021, and is projected to reach $7.40 billion by 2031, witnessing a CAGR of 16.2% from 2022 to 2031.

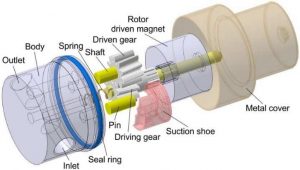

Micropumps are utilized in the healthcare sector for regulating and working with a small quantity of fluids. They are axial and centrifugal pumps that function on different principlesa as compared to conventional pumps as their dimensions lie within the micrometer range. Micropumps are used in a wide array of applications such as fluid mixing, fluid transportation, and dispensing medication with precise amount of doses. Some of the medical applications for micropumps include blood transportation using artificial hearts, pain and wound care management, hormone therapy, transdermal insulin delivery, and injection of glucose.

Increase in number of manufacturers of micropump, surge in research activities that increase the demand of micro pump, and rise in number of biotechnology and pharmaceutical companies drive the growth of the global micropump market. For instance, some of the major micropump market players include TTP Ventus, Idex, Thomas (Gardner Denver), Takasago Electric, Inc., Bio-Chem Fluidics (Halma), The Lee Company, Dolomite Microfluidics (Blacktrace Holdings Ltd.), Cole-Parmer India Pvt. Ltd., and Servoflo Corporation. Furthermore, surge in number of chronic and infectious diseases that raise the demand for micropumps for in-vitro diagnosis procedures and, increase in prevalence of chronic diseases such as diabetes and cancer that require chemotherapy and insulin therapy supplement the market growth.

Significant increase in number of innovative micropump launches boosts the micropump market growth. For instance, TTP Ventus, one of the micropump manufacturing company, launched its new product line the LT Series in June 2019. The new products are developed for fulfilling the requirement in various applications across medical, industrial,life science, and environmental sectors. This product launch enabled the company to raise its overall product portfolio. Moreover, increase in prevalence of chronic diseases such as cancer leads to the rise in application of micropumps in the medical treatments. According to the National Cancer Institute, the estimated number of new cases of cancer in the U.S. was 1,806,590, and the estimated number of deaths was 606,520. According to the World Cancer Research Fund International, nearly 18,094,716 new cancer cases were diagnosed worldwide in 2020. According to the same source, the breast and lung cancer were the most common types of cancer across the world, accounting for 12.5% and 12.2% of the total new diagnosed cases respectively.

Based on type, the market bifurcates the market into mechanical and non-mechanical. The mechanical segment held the highest market share in 2021, and is projected to maintain this trend throughout the forecast period, owing to technological advancementsof mechanical micropump, availability of different types of micropumps, and surge in usage of mechanical microscopes in micro-electro-mechanical systems (MEMS) that were used in drug delivery.

Based on material, the report further classifies the market into plastics & composites, metals, and ceramics. The plastics & composites segment accounted for the highest market share in 2021, and is expected to maintain this trend throughout the forecast period. This is due to rise in use of plastics& composites in mechanical micropumps and technological advancements in the healthcare sector.

Based on application, the research further segments the market into drug delivery, medical device, in-vitro diagnosis, and others. The drug delivery segment held the highest market share in 2021, and is projected to maintain its trend by 2031. This is attributed toincrease in drug delivery applications, rise in awareness about the controlled drug delivery, and surge in number of chronic diseases including cancer and diabetes.

Based on end user, the report further segments the market into hospitals & diagnostic centers, academic & research institutes, and biotechnology & pharmaceutical companies. The hospitals & diagnostic centers segment held the highest contribution of the market in 2021, and is projected to maintain its dominance throughout the forecast period. This is attributed to increase in number of hospitals, rise in the government expenditure for development of healthcare infrastructure, and surge in number of chronic diseases.

Based on region, North America held the largest market share of the global micropump market in 2021, and is projected to maintain its dominance throughout the forecast period. This is attributed to rise in number of research and development activities, technological advancements in healthcare, and surge in the prevalence of chronic diseases. However, Asia-Pacific is projected to witness a steady growth, owing to surge in expenditure by government organizationsfor developing the healthcare industry, rise in prevalence of chronic diseases, and increase in number of key manufacturers of micropumps.

The COVID-19 pandemic made a positive impact on the global micropump marketgrowth. Rise in expenditure by private healthcare organizations and governments for treatment of the COVID-19 infection propelled the demand for micropumps. In addition, the demand for treatment and investigation purposes increased considerably during the pandemic.

Key Findings of the Report:

- Based on type, the mechanical segmentheld the highest contribution in the market in 2021.

- Based on material, the plastic & composites segment accounted for the highest market share in 2021.

- Based on application, the drug delivery segment held the highest share in 2021, and is projected to continue its dominance during the forecast period.

- Based on end user, the hospital & diagnostic centers segment contributed the market share in 2021, and is projected to maintain its dominance throughout the forecast period.

- By region, North America generated the largest revenue in 2021. On the other hand, Asia-Pacific is expected to register the largest CAGR from 2022 to 2031.